In his 2021 Jackson Hole speech, Powell was cautious to not threaten the economic recovery. The unemployment rate was around 5% this time last year, and millions of previously employed Americans remained out of the labor force. Powell was openly lobbying for a second stimulus package in late 2020, claiming that it would be far better to do too much than too little. It’s easy to forget just how concerned the Fed was about the state of the labor market in the aftermath of the Covid-19 lockdowns. “So far, we have expeditiously raised the policy rate to the peak of the previous cycle, and the policy rate will need to rise further.” The Labor Market Is Holding On

“We are in this for as long as it takes to get inflation down,” Brainard said. That suggests there is a long way to go before inflation normalizes, which is why the Fed is so dedicated to increasing interest rates and lowering its $8 trillion balance sheet via quantitative tightening. She noted that the price of goods are still well above where its pre-pandemic growth rate suggested, while the price of services had yet to catch up. In a recent speech in New York, Fed vice chair Lael Brainard outlined the current state of inflation.

Feds fund rate next meeting full#

Not only is that well above the Fed’s 2% target, but it’s a full percentage point higher than the July 2021 reading. The July core personal consumption expenditures (PCE) reading, which strips out volatile food and energy costs, showed prices rising at 4.6% over the prior 12 months. Then the July CPI report dropped to 8.5%, thanks to falling gasoline prices. When the FOMC last met, the June consumer price index (CPI) report showed inflation up 9.1% over the prior 12 months. While peak inflation may have arrived, annual price gains are still incredibly high.

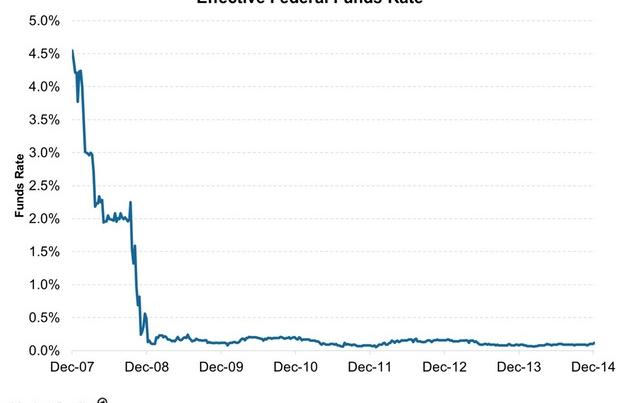

While this sort of dedication is necessary to moderate sky-high prices over the longer term, markets have been moody over recent weeks.īefore Powell’s speech at Jackson Hole, investors had been hoping that worsening economic conditions would prompt the Fed to ease off rate hikes sooner than expected. “I can assure you that my colleagues and I are strongly committed to this project and we will keep at it until the job is done.” “History cautions strongly against prematurely loosening policy,” said Powell in a recent speech to the Cato Institute. The meeting will also feature the release of the Fed’s latest economic forecasts, the summary of economic projections (SEP). The FOMC raised the federal funds rate by 75 basis points (bps) at the June and July meeting, following a 50 bps hike in May and a 25 bps raise in March.Īccording to the CME Group’s FedWatch tool, there’s a nearly 9-in-10 chance that the committee will deliver another 75 bps hike later this month. Investors are deeply anxious to hear more about how this vow will come to pass. The Federal Open Market Committee (FOMC) will convene again on September 20-21, just three weeks after Fed Chair Jerome Powell famously reiterated his vow to crush inflation.

0 kommentar(er)

0 kommentar(er)